Remember the days you could stroll into a department store and walk the aisles? Those days might soon be over.

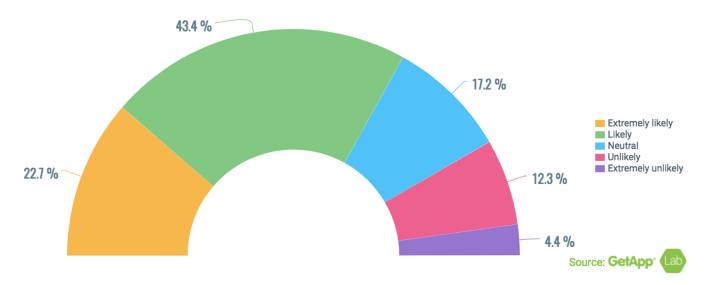

According to research conducted by GetApp Labs, we are witnessing a major shift towards online shopping. The study surveyed 200 US retailers with inferred annual income of $24,000-$150,000. The key question posed by the researchers was, “Do you plan to abandon brick-and-mortar stores in favor of online or web-based retail in the next 10 years?”

Over 66% of participants agreed, answering either “likely” or “extremely likely.” One-sixth of the respondents maintained that they would hold on to their physical store locations for as long as they are still profitable. Is sticking with the traditional model a rational choice, or simply resistance to change?

Reasons to Switch to Online

Perhaps the question itself is loaded, forcing respondents to provide the answer that is expected. Perhaps 10 years is too long to predict in a world where tech is developing at an insane pace. Still, if your response is a categorical “no”, you had better have a very specific niche product and audience.

Retailers have excellent reasons to shift to online, and to shed their brick-and-mortar outlets. Here is why.

Big fish, small fish

Local retailers and mom & pop businesses continue to lose market share to major retail players in what has now become a global trend.

When Wal-Mart moves into town, smaller brick-and-mortar stores have relied on building personal relationships with customers and community members in order to survive. In time, those relationships may fade in favor of lower prices and a wider range of products at the retail giant.

So, SMBs have only two options: fight the inevitable or switch to an online sales model.

Big fish, bigger fish

Major players are having a hard time, too, as large department stores have lost their once-reliable market share.

Macy’s closed 68 stores in the US alone, HHGregg filed for bankruptcy, and these are not the only cases. Malls are becoming ghost towns. Where department stores used to anchor malls, drawing in smaller stores and a solid stream of shoppers, their absences now hurt the smaller satellite businesses that depended on department store crowds.

The reason for this decline is obvious: retailers say they simply cannot compete with Amazon as online shopping gains in popularity.

The picture is not very different in Europe, where the German retail federation HDE (Handelsverbrand Deutschland) reports declining profits in offline retail nationwide. Grocery chains alone have managed to keep strong sales as every other niche experienced a substantial decline, especially Apparel & Accessories and Consumer Electronics.

There may be rough times ahead for European brick-and-mortar grocers, however, given recent trends in the U.S., where Amazon’s bid to acquire major organic food retailer Whole Foods is causing grocery chain stocks to plummet.

HDA: “2016, online is going to be a retail driver in Germany: e-sales turnover is to grow by 11% and reach 43,3 billion Euro, while overall retail turnover will grow by 2% for a total of 481,8 billion Euro.”

There are other factors favoring switching to online retail:

Savvy Consumers

While brick-and-mortar retail remains the choice of an older generation, millennials prefer to get their shopping fixed online.

In the good old days, people came to stores to compare prices, ask advice, and make a purchase. Today, 85% of customers read product and seller reviews before ultimately buying online.

Instead of relying on store prices, modern consumers are able to make a quick comparison between sites worldwide. Their search begins with the search box and often ends in some online store across the globe, say in Malaysia.

This change in shopping patterns leads many retailers to reconsidering a possible aversion to an online-driven model. But wait, there’s more!

Changes in Shopping Patterns

Brick-and-mortar stores still had an ace up their sleeve — frequent purchases with a regular pattern.

Customers would go on weekly shopping sprees to restock their food supplies along with other essentials: pet food, personal hygiene products, wine and so on… Larger retailers knew that consumers would avoid driving to a pet store if they could buy pet food a big mall nearby with everything in it. All routes led to the mall.

Today, however, another shopping pattern is emerging due to scheduled online sales gaining popularity. Why go anywhere if you can just mark the products you want and get a monthly delivery right up to your door? Online retail is handy like that.

Gathering Customer Data

Customer profiles allow businesses to know their audience better, to provide product recommendations, to communicate with their audience through emails or web push notifications (always choosing the right segment), to bring back past customers through remarketing display ads, etc.

It’s much easier to collect, organize, and analyze customer data online than at physical locations. eCommerce platforms such as REES46 provide this invaluable service. Clunky and incoherent customer profile data has now given way to advanced analytics. Companies that switch from an offline business model to an online or omnichannel one can reap the benefits of using this smart, expanded cache of customer data.

Ultimately, there are costs and drawbacks associated with both approaches (online and offline). Brick-and-mortar stores, in addition to all the reasons already listed, incur rental expenses for their stores and warehouses locations; labor expenses; limited store hours (unlike 24-7 online shops); and geographical limitations.

For all their advantages, online sellers also encounter specialized costs: getting a website, promoting their online store, embedding online payment gateways, paying for professional advice, etc.

Despite these added expenses, small, medium, and large businesses alike are rushing to switch to an online-driven model.

So, Will Offline Shopping Become Extinct?

It seems audacious to say that in 10 years we will no longer see a brick-and-mortar store. Could it be?

The limited sample size (200) of the retailers involved in the research project suggests a need for further research.

However, from the preliminary results, it would seem prudent for small businesses to prepare the ground for a safe takeoff into online. You heard it here first.